The growth and expansion of the stock market over the past two decades have been commendable. It has gained popularity and the bulk of new investors of different age groups. Today, youngsters also take a keen interest in investment options in the stock market because the operations can be performed online. There is no doubt that the online trading option has turned out to be a blessing for the investors.

Many investors used to refrain from participating in the stock market because of the complexities it brings. One had to hire brokers and handle the risk of acquiring share certificates physically. However, the new-age investors are well aware of what is Demat account and how it helps in online trading.

A wise investor should always analyze the stock market carefully. Source: Pixabay

Mistakes To Avoid While Investing In Shares

There are a lot of people who jump into the share market just by looking at the success of investors around them. And then, there are very few investors who give it a fair amount of thought and try to learn the basics of investment before actually starting the process. Some of them also fall into trouble by completely relying upon brokers without acquiring any prior knowledge about the market mechanisms. Some of the common mistakes that should be avoided while investing in shares are:

1. Insufficient Amount of Knowledge

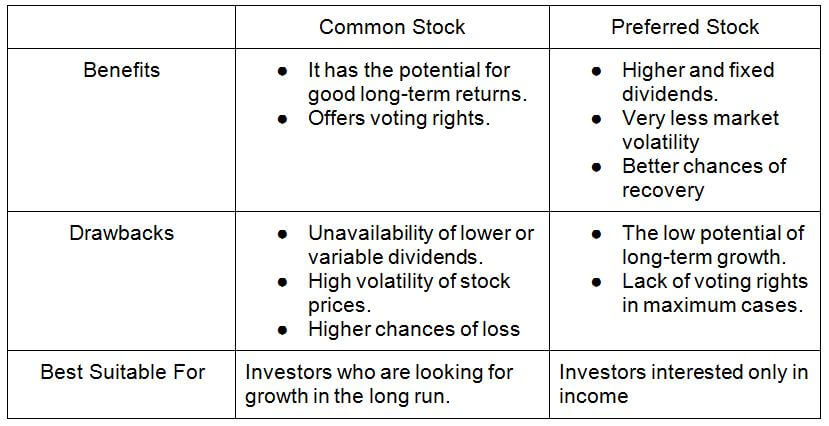

The share market is just like the exam that we feel we would pass because it seems easy. No matter how simple it seems, one should never enter the stock market without any basic knowledge of the subject. The first step is to learn – How the stock market works? What are the key components of investment? How many types of shares are there? What is the Demat account? All these questions must be answered before putting money out of pocket. For a basic start, consider the following table which explains the two types of stock:

2. No Prior Planning

2. No Prior Planning

An investment without a good plan mostly turns out to be a failure. This also marks as one of the common mistakes made by beginners or inexperienced investors. There should be a proper plan of buying a share or bond. Also, one should be ready with a back-up plan in case things do not pan out as per the former plan. The share market is filled with uncertainties that are inevitable. A wise investor is one who is ready with a plan B if plan A fails.

3. Confusing Share Investment With Gambling

The reason most of the people face loss in the initial days of investing in the share market is because they confuse it with gambling. The thought “let us invest money in this share and see what happens” prevails until one faces a good amount of loss. Share market investments do not work in this manner. One should know how shares work, what is Demat account, and how things gi about in the share market. Thus, one should never treat this market as a casino as it does not work that way.

4. Altering Financial Planning

The stock market turmoil induces the investors to constantly change their financial plan of investment. This is where the job of financial planners is utilised. Most people rely upon professionals for helping them in making profitable share investments. However, an investor should spend an ample amount of time studying the market behaviour himself. Constant alteration in financial planning can turn out to be disastrous most of the time.

5. Lack of Diversification

It is a common saying that a rotten fruit spoils the barrel. This theory is very much applicable to the share market. The most common mistake made by beginners is relying upon one plan and constantly pouring money into it until it generates income. The share market is not run by only one investment plan. Instead, there are many types of investment options for an investor to choose from and invest in them after learning what is Demat account. Few of the common options are:

- Company stocks or shares

- ETFs (Exchange Traded Funds)

- Corporate Bonds

- Government securities

- IPOs (Initial Public Offerings)

- Index Funds

An investor is no lease than a learner who should keep striving for knowledge. Source:

Pixabay

6. Purchasing Shares on Credit

If reports are to be believed, only 5-10% of investors make good fortune and huge profits out of the share market investments while others make moderate income. Almost all these investors do not depend on credit tools for making investments in the share market. An investor should not take a loan for buying shares thinking that he would return it when he earns a profit. Along with that, it is better to consult a Depository Participant regarding what is Demat account and trading account for better results.

7. Ignoring the Power of Compounding

7. Ignoring the Power of Compounding

The inquisitive nature of an investor always inclines him to withdraw an investment as soon as it incurs a good amount of interest. Most of the people either do not know about the power of compounding or completely ignore it. However, a smart investor is one who does not withdraw investment in a short period of time. Comprehensive knowledge of the power of compounding will work to accumulate more wealth.

In India, the BSE (Bombay Stock Exchange) released a report in 2017 which revealed that more than 3.26 crores of new investors made new registration in the share market. All these people knew what is Demat account and opened one before making an investment. This explains how many people are invested in the share market and know the proper utilization of online trading tools as well. One should just avoid making common mistakes and learn from his past failures to turn into a successful investor.