There are several benefits to buying a property in a woman’s name, either as the sole owner or as a joint owner, with governments and banks offering several sops.

“Aspiring home buyers can seek certain benefits including tax exemptions if a home is bought in a woman’s name. Such offers can also attract more women buyers to the realty sector,” points out Ashok Mohanani, CMD, Ekta World. Encouraging women to register assets in their name, also boosts women’s empowerment, he adds.

Tax benefits

Tax benefits

Experts explain that some of the obvious tax benefits of buying a home in the wife’s name, include an extra deduction of interest up to Rs 1.5 lakh every financial year, if the house is self-occupied. If a husband and wife are the joint owners of a property and if the wife has a separate source of income, then they can both claim tax deductions individually. The tax benefit will depend on the ownership share of each co-owner.

Discount on stamp duty charges

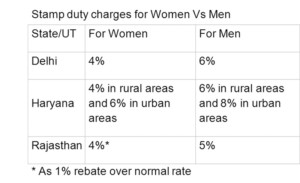

Several state governments in north India are now offering a partial waiver on stamp duty, for buyers registering properties in a woman’s name – either as a sole owner or as a joint owner.

“You can save 1%-2% on stamp duty, if the property is in a lady’s name. In Delhi, the stamp duty rate is 4% for women, compared to 6% for men. Moreover, if you are undergoing some financial setback and have some debts to repay, the property held in your wife’s name, does not come under the cover for your loss,” points out Sushil Raheja, CEO of Raheja Homes Builders & Developers.

Discount on home loan interest rates

Discount on home loan interest rates

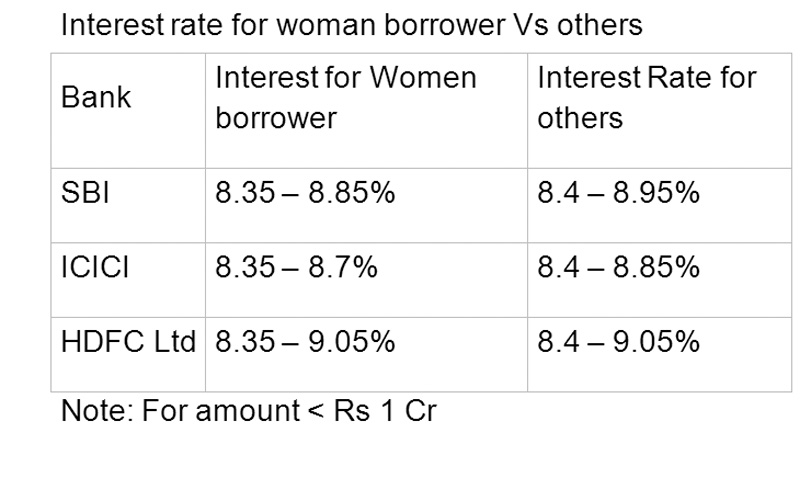

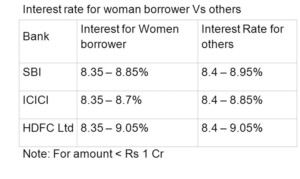

Many banks like SBI, ICICI and HDFC Bank, offer discounted rates on home loans for women borrowers. The prevailing interest rates for women borrowers are as mentioned below:

Interest rate for woman borrower Vs others

Things to keep in mind

Experts maintain that it is a good idea to buy a home in the name of one’s wife or in co-ownership. However, the wife can enjoy the tax benefit, only if she has a separate and genuine source of income. Moreover, if there is any legal dispute on the property, then both, the husband and wife, will be involved in the case. Therefore, home buyers should evaluate all possibilities, before making a final decision.-Courtesy Housing.com