Suresh Bodiwala

CHICAGO: The Cook County Board of Commissioners has enacted an ordinance that would increase disclosure in an area where it is long overdue—Tax Increment Financing districts, said the County Treasurer, Maria Pappas.

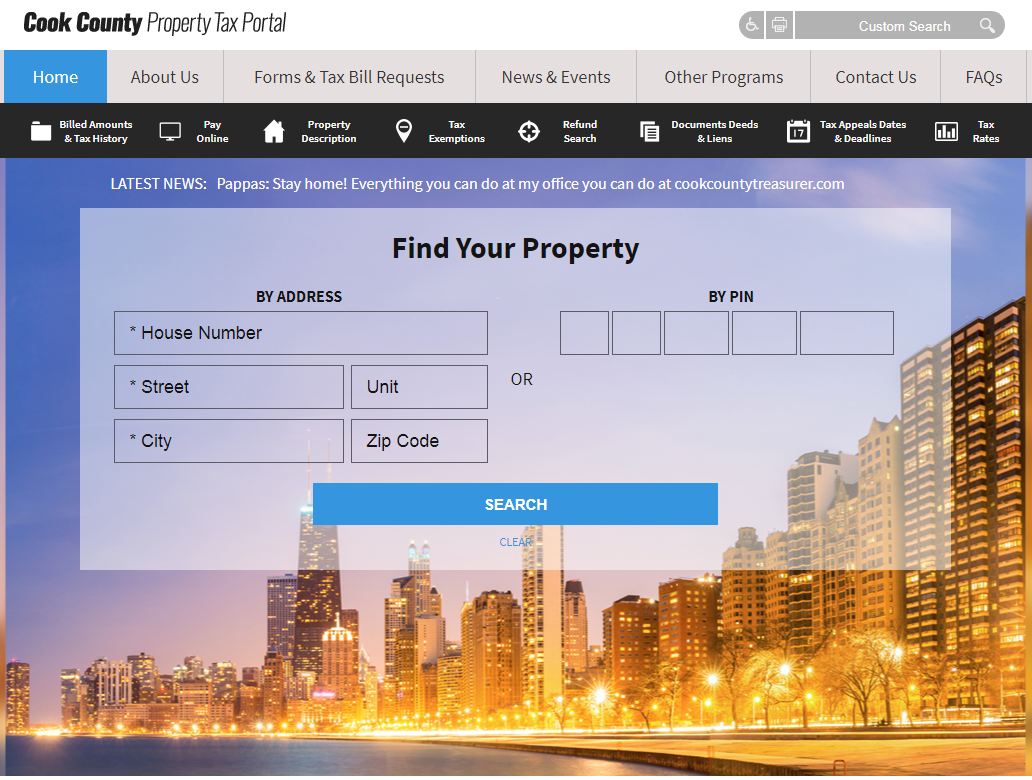

The Board approved an amendment to the Debt Disclosure Ordinance, which allows the Treasurer’s Office to gather vital financial data for the county’s 547 primary taxing districts and publish it on cookcountytreasurer.com

The amendment would give taxpayers opportunity to examine how TIF dollars have been spent and to whom. This information also would be posted to cookcountytreasurer.com for taxpayers to view and download.Pappassuggested the idea to the board and helped draft the amendment.

“The County Board took ground-breaking action regarding transparency when it passed the Debt Disclosure Ordinance in 2009 at my request,” Pappas said. “I am grateful to the Board for doing the same with TIFs.” Commissioners John P. Daley (11th) and Larry Suffredin (13th)were lead sponsorsof the amendment. Two commissioners voted no: Frank J. Aguilar (16th) and Scott R. Britton (14th).

In Cook County, 444 TIF Districts across 96 municipalities accounted for more than $1.3 billion in property tax revenue last year — or 8.4% of the entire $15.6 billion billed.