Surendra Ullal

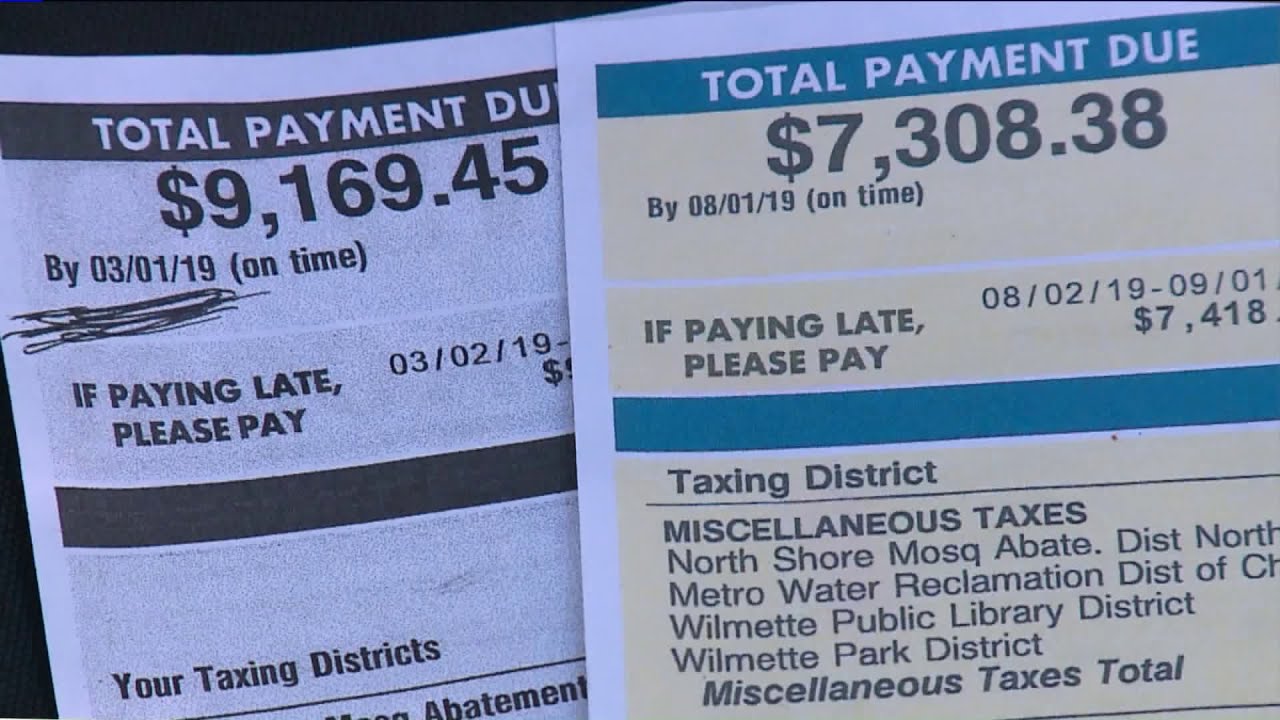

CHICAGO: Second Installment Cook County property tax bills have been posted to cookcountytreasurer.com, where property owners can see how much they owe two weeks before the bills are received in the mail in early July, Treasurer Maria Pappas said here.

The Second Installment is due August 3, but property owners can pay without any interest charge through October 1, 2020, thanks to an ordinance urged by Pappas and passed by the Board of Commissioners in May.

“Because of the recession, many homeowners and business people are worried about paying the Second Installment,” Pappas said. “By going to my website, they can read their bills and make plans.”

To download a copy of your tax bill or to make a payment, visit cookcountytreasurer.com:

- Select the blue box labeled “Pay Online for Free”

- Search by property address or enter your Property Index Number (PIN)

- There is no fee if you pay from your bank account

Second Installment bills include any property tax reassessments and exemptions calculated by the county assessor and tax rates calculated by the county clerk.

The printed bills, with a due date of August 3, are to be mailed by the beginning of July. Payments after October 1 will be charged 1.5 percent per month, as required by law.