MUMBAI: The Reserve Bank of India (RBI) on Wednesday cut interest rate by a rare 35 basis points — the fourth successive reduction — to a nine-year low, in an attempt to boost an economy growing at its slowest pace in nearly five years.

The central bank reduced its growth projection for the Indian economy to 6.9 per cent for the current financial year, from 7 per cent forecast in June, due to a slowdown in demand and investments.

The RBI, which has lowered the repo rate by 1.1 percentage points this year, maintained its “accommodative” stance that meant an increase is off the table.

The repo rate is the rate at which the RBI lends to banks.

With four of its six members voting for a 35-basis point reduction, the Monetary Policy Committee (MPC) reduced repo rate to 5.4 per cent — the lowest since April 2010. The reduction was larger than the expectation of a 25-basis point cut.

The remaining two MPC members voted for a 25-basis point cut.

The reverse repo rate was lowered to 5.15 per cent.

The previous instance of four successive rate cuts happened between April 2012 and May 2013 when the repo rate was reduced by 1.25 percentage points — 50 basis points (bps) on April 17, 2012, followed by 25 bps reduction each on January 29, 2013, March 19, 2013 and May 3, 2013. The repo rate during this period came down from 8.50 per cent to 7.25 per cent. This was a period prior to the advent of the MPC, when the RBI alone decided on interest rates.

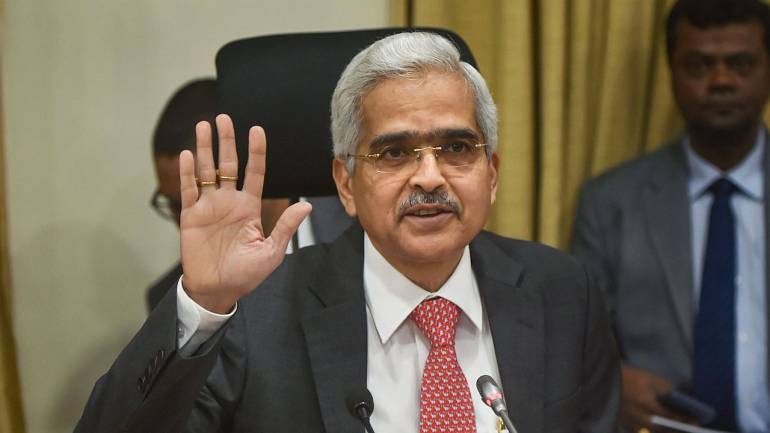

RBI Governor Shaktikanta Das, at a media briefing, said the MPC was of the view that a 25-basis point cut was “inadequate”, while a 50-basis point reduction would have been “excessive”. So, a 35-basis point easing was deemed “balanced”.

The central bank has since 2006 changed interest rates by 25 or 50 bps only.

Das said a “demand and investment slowdown was having a dampening effect on growth”. He, however, hastened to add that at this point of time, the slowdown appears to be cyclical in nature and not deep-structural slowdown.

“Nevertheless, there is a need for structural reforms,” he said, adding that growth is likely to pick up towards the fourth quarter of the current financial year.

“Domestic economic activity continues to be weak, with the global slowdown and escalating trade tensions posing downside risks,” the MPC said in its statement. “Addressing growth concerns by boosting aggregate demand, especially private investment assumes the highest priority at this juncture.”

Finance Minister Nirmala Sitharaman, who kept government spending in check in her maiden Budget last month, had called for a “significant” reduction in interest rates to help revive growth.

“Even as past rate cuts are being gradually transmitted to the real economy, the benign inflation outlook provides headroom for policy action to close the negative output gap,” the statement added.

India’s GDP had grown by 5.8 per cent in the January-March quarter.

This is the fourth time in a row that the RBI has reduced the repo rate. In the earlier three policies, it has reduced the repo rate by 25 bps each.

Consumer Price Index-based or retail inflation is projected at 3.1 per cent for the September 2019 quarter and 3.5-3.7 per cent for the second half of the current financial year, with risks evenly balanced.

The next meeting of the MPC is scheduled during October 1, 3 and 4, 2019.

Suvodeep Rakshit, senior economist at Kotak Institutional Equities, said the RBI has continued with the rate cut cycle but surprised with a change in the quantum.

“While this induces some uncertainty in market expectations of the quantum of rate changes, it provides the RBI MPC with a greater degree of flexibility in signalling its intent,” he said. “The 35-basis point rate cut should be seen as a signal that the RBI MPC is quite concerned with the growth outlook beyond the usual 25 bps rate cut in a business-as-usual scenario (even though it does not reflect in the revised 2019-20 GDP growth estimate). The RBI MPC did not necessarily want to deliver a 50 bps rate cut and, hence, retains the scope to reduce rates further.”

Transmission of lending rates will likely remain weak unless there is clear visibility of adequate liquidity sustaining over the medium term, he added. PTI