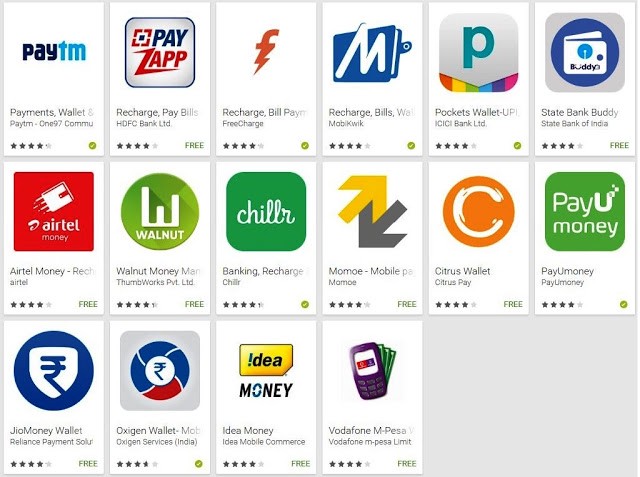

India is one of the fastest developing countries these days and the fastest growing in terms of technology. An obvious fact is that they have a bigger and more demanding needs for e-wallets. Although there are countless providers of this kind in the country, we managed to create a list of top 5 and to reveal why they are so desirable.

PayTm

PayTm is the oldest and the most commonly used provider of the kind. You can use it for any form of payment in the real world and online. If you want to find an online casino in Indian rupees, make sure this e-wallet is supported. It will make deposits and withdrawals much easier. Users like the PayTm due to easy to use interface, countless discounts and great promotions all available 24/7.

When you take a deep look in the ewallet you can see multiple cashback options. They are also present frequently in the user interface and make this provider stand out from the crowd. Other than this, we can add that PayTm is a semi-closed e-wallet.

Amazon Pay

Amazon Pay has 33 million users in the country and the number is rising as we speak. They use simple and appealing UI for their e-wallet and yes you can make various payments as much as you like without any issues or complications. The e-wallet works like any other and can be used for various online merchants.

This e-wallet was released in 2007 but it reached India 10 years later in 2017. One of the reasons is the fact you were able to use the e-wallet for purchases on Amazon site only, in the beginning. Now users can use the medium to pay for any service or good online.

Google Pay

Google Pay is far from the oldest provider in the country. As a matter of fact, they are relatively new to the country. Nevertheless, Google Pay has over 25 million users which places it on the top of many lists. A user will link their bank account to the e-wallet and link their phone number. After that, all transactions and all types of payments are available.

As a user, you can send and receive money, pay for bills, recharge the phone credit and so much more. There is no need to go to the bank ever again in order to reload the e-wallet. Google Pay is one of the safest e-wallets out there!

Mobikwik

Mobikwik is the oldest e-wallet in India and the one that has millions of users in 2020. The e-wallet is semi-closed in design and has a nice user interface, modern in that matter. A user can load the funds to the e-wallet and use it afterwards for paying bills, recharging the smartphone credit and so much more. Yes, you can use it for online payments as well and for land payments.

The number of options doesn’t stop there. The e-wallet allows you to fund the account using any credit or debit card found in India and also to collect points while doing so. Those points can help you save more money in the long run. But, to use this money-saving option you will need another type of e-wallet called Supercash. It is a loyalty-based service developed and launched by Mobikwik.

Freecharge

Freecharge has been a very popular e-wallet in the country for years. It does all the things you may need to complete at some point. This especially refers to the ability to pay the bills, to recharge your phone number and also to send the money to a bank account. All you have to do is to link the credit or debit card and you are ready.

The e-wallet can be used for online purchases, for paying almost anything you like on the web and all of that with a high level of security. Users have the ability to use their official website or the app to complete transactions.

Conclusion

All of these 5 e-wallets are extremely popular in India and they have been used by millions. Each one has a different, but a high level of safety and security provided for its users and you can use each one for countless purposes.