Expectant couples have a huge task at their hands, as they need to think about their child’s welfare and future before it steps into this amazing world. Successful parenting is not a simple job! Apart from taking care of your child’s mental & physical well-being, you need to secure your child’s future.

Parents want their children to become successful in life and education is an integral part of that dream. Apart from fulfilling the necessities of the children, parents should be ready with child future planning, so that they do not face any difficulties in the future. The first and foremost step to child future planning is investing in a child education plan.

Apart from education, the other key milestones are career and marriage, which can be managed if your children secure the best education.

What are child plans

The financial planning for your child’s future should start at a very young age! These plans comprise children insurance plans and children’s education plans.

The cost of education is rising with each passing day and planning the investments smartly will help in securing the educational milestones of your children. Earlier you plan, better it is for your children’s future.

Primary benefits of Children Education Plan

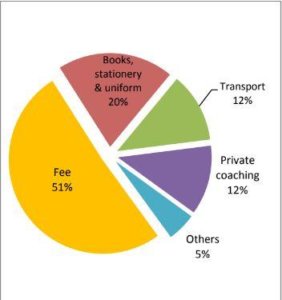

As a financially aware parent, you have to calculate the education expenses against the rising inflation in the country. The spending starts right from the time your child starts going to school. Apart from school fees, there are many other components such as stationery, transport, private coaching, and more that add up to expenses.

There is a huge difference between children’s education plans from regular term plans or other United Linked Insurance Plans (ULIPs) available in the market. Here are some of the prime features of a Children Education Plan:

1. Growth of investment

With such plans, you can grow your money by investing the same in debt and equity funds for the long term. It is an investment that helps you beat inflation, along with protecting your investments.

2 Securing your loved ones in your absence

There is life cover along with the plan. Hence, your child gets all-round protection. If the policyholder meets with some unfortunate event during the policy term, the child receives a lump-sum amount. This amount will be useful in fuelling your child’s dreams, as it can give wings to their dreams even in your absence.

3. Longer, the better

Like other investment plans, the longer your stay invested, the better it is for you and the nominee. ICICI Prudential Smart Kid Solution with ICICI Pru Smart Life- a Unit Linked Insurance Plan is an ideal gift that you can offer your children as it grows your investments, along with securing the educational milestones of your children.The company adds Loyalty Additions that further helps in the growth of your investment.

4. Useful rider options

The best part of children’s education plans is that they can be customized as per your requirements, just like term insurance plans. Rider options like part withdrawal are useful in providing financial support to your child’s education and availing maturity benefits.

Many insurance companies permit the policyholder to withdraw a part of the invested money starting from the fifth (or sixth) policy year. The duration will purely be dependent on the insurance provider and T&C mentioned in the policy document.

5. Tax Benefits

It helps in reducing your taxable income by investing up to Rs. 1.5 Lakh under Section 80C of Income Tax Act, 1961. The best part about this investment is that you are saving tax, leveraging benefits of the market through investment in debt (or equity) funds, and securing your child’s future.

Consider a sample scenario where the minimum cost of securing an MBA from a top-notch Indian college is Rs. 10 Lakhs. By factoring in the rising cost of education and the current inflation rate, the cost after 10~12 years could be around Rs. 25~30 Lakhs.

A sound investment plan that provides good returns over a period and secures your child’s future in your absence would be required to realize your child’s education dreams!

ICICI Prudential Smart Kid Solution with ICICI Pru Smart Life is one such plan that can be tailor-made as per your requirements and ensures that your money is with your children when they need them the most.